What are the corporate tax rates? There are different rates for. KPMG’s corporate tax table provides a view of corporate tax rates around the world. UK ’s new chancellor, Rishi Sunak, today presented his first Budget to Parliament. Corporate Tax Rate in the United Kingdom averaged 30.

The rate was earlier proposed to be reduced to percent.

Accordingly, the legislation will need to be amended post-election to maintain the rate at percent for FY20. In their argument, Clausing and Kleinbard contrast the CEA’s predictions that a corporate rate cut would lead to wage growth to the of the UK ’s recent experiment with corporate tax reform. Surprisingly, as the UK cut its corporate income tax rate, the country’s inflation-adjusted median wage also dropped. All European countries tax corporate income.

However, corporate income tax (CIT) rates differ substantially across countries, ranging from percent in Hungary to 34. Europe’s average CIT rate (2 percent) is slightly higher than the global average (2 percent). The map shows statutory CIT rates in European.

The branch rate column includes the corporate tax rate applicable to branches, as well as any applicable branch tax imposed in addition to the corporate income tax (e.g., branch profits tax or branch remittance tax ), as described in the notes column. Talk:List of countries by tax rates.

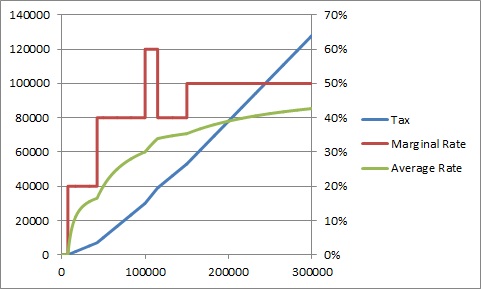

Top federal marginal corporate tax rate in the US is according to every source I can find including other sources in. Companies use everything in the tax code to lower the cost of taxes paid by reducing their taxable incomes. When President Trump signed the Tax Cuts and Jobs Act (TCJA) into law on Dec.

You need to pay Capital Gains Tax (CGT) when you profit from selling valuable assets such as shares, cryptocurrencies, art, or property. Individuals have a £10capital gains tax allowance. This means your capital gains up to £10are tax free. The US federal tax rate for corporations is - the highest in the OECD.

But very few businesses in the US actually pay the top rate , thanks in part. The standard commercial tax rate in the UK is , although certain goods and services are subject to lower UK commercial tax rates. VAT exemptions are also offered on certain items, for example, long-term medical supplies. Among other things, P. Papua New Guinea levies corporate income tax (CIT) on companies on a flat rate basis. The basic rate of Part I tax is of your taxable income, after federal tax abatement.

After the general tax reduction, the net tax rate is. For Canadian-controlled private corporations claiming the small business deduction, the net tax rate is: Generally, provinces and territories have two rates of income tax – a lower rate and a. If your company is based outside of the UK , it must pay corporation tax on all taxable profits that were made in the UK. Republicans championed the tax plan as beneficial to business and consumers and Democrats claimed it would only increase the wealth of the already wealthy.

Down towards the bottom of the statement, locate the income tax expense, usually called provision for income taxes.

To arrive at taxable profit, some charges are. To get an idea of the effective corporate tax rates around the worl we can look at data compiled by the Organisation for Economic Co-operation and. Tax rates vary based on the corporate laws of each nation.

Comments

Post a Comment