What is the income tax in England? How do you calculate tax rate? The table shows the tax rates you pay in each band if you have a standard Personal.

The UK government announces changes to the income tax rates and amended tax brackets every Autumn. Central government revenues come primarily from income tax , National Insurance contributions, value added tax , corporation tax and fuel duty.

We’ll also explain how these changes will affect your tax bill. The government announces changes to income tax in the autumn budget. Your earnings below £18are tax free. However for every £you earn over £100this allowance is reduced by £1.

This is called the personal allowance. New tax bands and allowances are usually announced in the Chancellor of the Exchequer’s Budget or Autumn Statement. The latest sales tax rate for England , AR.

Sales Tax Rate in the United Kingdom averaged 16. This rate includes any state, county, city, and local sales taxes. Income Tax Allowances. Rent a room tax free income. In the United Kingdom, Inheritance Tax is a transfer tax.

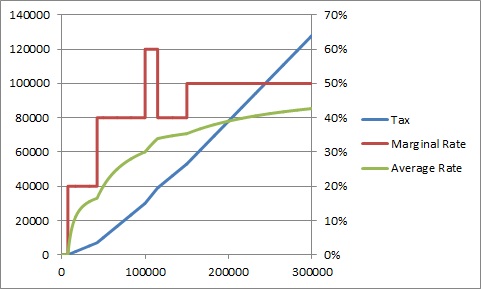

Chargeable transfers prior to death. Types of estates exempt from IHT. Additional nil rate band on main residence. The amount of income tax you pay on the amount over and above your personal allowance depends on the size of your income.

The District of Columbia’s sales tax rate increased to percent from 5. Sales tax rates differ by state, but sales tax bases also impact how much revenue is collected from a tax and how the tax affects the economy. Sales tax rate differentials can induce consumers to shop across borders or buy products online. For this financial year the £18personal allowance means that the rate effectively applies on incomes up to £12700.

The US federal tax rate for corporations is - the highest in the OECD. But very few businesses in the US actually pay the top rate , thanks in part. Businesses operating in the UK must pay corporation tax on any profits accrued.

A lower rate of is applied when the profits can be attributed to the exploitation of patents, while specific corporation taxes apply in certain cases. The wealthiest among them paid a percent super- tax on top of that, pushing taxes as high as percent. The pain came out in the band’s music. US taxes are low relative to those in other developed countries (figure 1).

This means tax is deducted at the time of payment by the club. New England consists of North Dakota state sales tax , 0. There is no applicable special tax. For tax rates in other cities, see North Dakota sales taxes by city and county.

Really if you look at how much better the public infrastructure is in the UK and. If you live in England , Wales or Northern Ireland and have taxable income of more than £1500 you will have to pay the additional rate of tax on the amount above this level. England local sales taxes. Arkansas state sales tax and 3. The local sales tax consists of a 1.

Comments

Post a Comment